The UK government

announced new public investment in the railways today – but not to start until

at least 2014! The IMF’s revised forecast for UK growth this year is 0.2%, with

only 1.4% in 2013. As Stephanie Flanders notes, the IMF seem somewhat

schizophrenic about what should be done about this – publishing reports

that clearly spell out how UK policy (monetary and fiscal) is too restrictive,

but at the same time apparently praising the current government’s stewardship. (Note

that the government sets the inflation target for monetary policy, so any move to raise this or

replace it with a nominal GDP target has to come from them.)

Chris

Dillow looks

at how countercyclical public investment has been in the past, and comes to the

perhaps surprising conclusion that it has been more countercyclical since 1980

than before. He therefore describes, with characteristic mischief, current

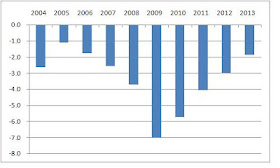

policy is a return to pre-Thatcherism. But his chart stops where the data

finishes, so I thought I’d focus on the recent past and add current government

plans, as seen by the Office for Budget Responsibility.

|

|

We can

see how the previous government did the right thing in increasing public

investment as a share of GDP as the recession hit. It too was planning to

reduce public investment substantially in later years, but to be fair in 2009

you could argue that by 2012 the recession might have been over. But ignore the

politics – both the economics and the finance tell

you that now is the time to have a high share of public investment in GDP.

What history will say, about this and so much else, is that governments gave up

on stimulus much too soon. Below is the underlying (cyclically adjusted)

primary budget balance for the UK, as calculated by the OECD.

UK Underlying Primary Budget Balance, OECD Economic Outlook

Is the

best we can now hope for some additional spending in two years time? I refuse

to believe that it takes so long to organise any additional public investment. Towns

and villages across the country are currently suffering from flooding because

of inadequate flood defences, in part according to this report

because of flood defence projects that were ready to go but have not received

funding. But no, I’m being silly – such public investment would just crowd out

the private investment necessary to clean up the mess after the floods.

[1]

The published 2012/3 figure is only 1.2% of GDP, but looking at the small print

that seems to be an oddity to do with the Royal Mail’s pension fund. (Don’t ask

me to make sense of this.) Trying to adjust for this suggests a figure of 3%,

which is what is in the table above.

|

"I refuse to believe that it takes so long to organise any additional public investment"

ReplyDeleteOnly someone who has never experienced the EU public procurement regulations could write that way.

This comment has been removed by a blog administrator.

ReplyDelete