If you read some of the UK headlines, it seems that France is having difficulty adjusting to the reality of longer lifespans. Its previous retirement age (the age when you can get a state pension) was 62, which is well below most other countries. Macron has made that 64, in a reform imposed on parliament. 64 is still relatively low, yet there have been strikes and demonstrations against this change that have been large even by French standards. A rolling strike by bin collectors in Paris has left rubbish on the streets. Commentators are asking whether these protests will bring about the end of the current constitutional order in France.

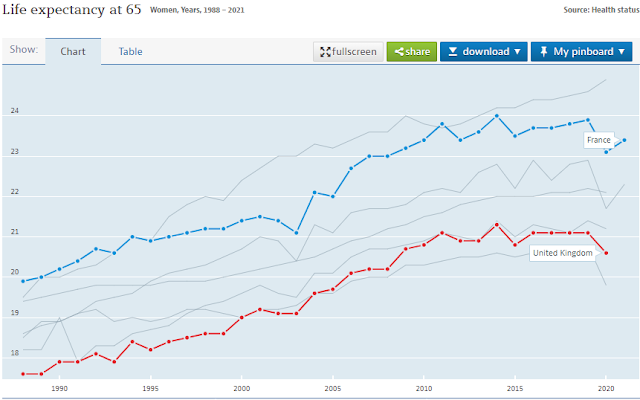

At a macro level, it makes sense to raise the pension age alongside life expectancy. In most European countries, including France and the UK, state pension schemes are unfunded, which means that today’s pensions are paid for by those working today. If people live longer you either need to reduce the value of the state pension, raise those contributions, or raise the retirement age. Yet while the life expectancy of those reaching 65 increased substantially in the decades before 2010, increases have been more modest since then. The OECD data below is for women in the G7 countries. Note that UK life expectancy has always been low compared to all other G7 countries except the US.

The French pension age was raised to 62 from 60 in 2010, and by 2019 (before Covid) life expectancy at 65 had risen by around half a year since 2010. So the case for raising the retirement age in France from 62 to 64 is not obviously because of increases in life expectancy since 2010. Indeed projections suggest that the French pension system, while it will go into deficit at the end of this decade, will break even again by 2035 without any increase in pension age.

So how does France afford to have a relatively low retirement age compared to other countries? It is not because state pension levels are low. France spends around 12% of GDP on state pensions, which is significantly higher than the OECD average, which itself is above the UK. The answer therefore has to be higher levels of contributions, either directly or indirectly through a tax subsidy. I noted in a recent post that although France had higher levels of productivity than the UK, mean household incomes were not higher, and a major reason for this is that French workers retired earlier. Higher French productivity was paying for a lower retirement age than the UK and elsewhere, rather than higher post-tax incomes.

France has not always been an outlier in terms of having a low retirement age. It was the socialist President François Mitterrand who in 1981 cut the retirement age from 65 to 60. Has France got this trade-off between income and retirement right, as Simon Kuper suggests, and most other countries have it wrong? The strength of popular feeling against Macron’s higher retirement age would suggest French people think so, although it is impossible to know how much of this is seeing a benefit (retiring early) without seeing the cost of that benefit (lower post-tax incomes while working).

The first lesson that France has to teach the UK (and perhaps other countries) is to have that debate. One of the consequences of having a predominantly right wing press and a predominantly right wing government is that early retirement in the UK is seen as a problem, rather than an achievement. Debates over pensions in the UK too often treat contribution rates as given, rather than part of a trade-off between the retirement age and contribution levels. As I have noted before, the UK debate typically fails to place things into an intertemporal context, and instead talks about workers versus pensioners as if workers will never retire.

The second lesson that France has to teach the UK is whether it makes sense to have a national retirement age at all. Once we move from the aggregate to thinking about individuals, the unfairness of a uniform retirement age becomes obvious. If the retirement age was 64, someone who starts work from the age of 18 will work (and therefore contribute) for 46 years before retiring. Someone who has a degree will, if they retire at 64, work three years less but still get a state pension. It would seem to be fairer at an individual level to do away with a retirement age, and instead be allowed a full state pension after working a certain number of years. (The option to retire before that number of years should always be available, but with a less than full pension.)

This unfairness is recognised in France, but not in the UK. France has had a ‘long careers’ provision where those who started working at an early age can retire on a full pension before the official retirement age. That system is strengthened as part of raising the retirement age to 64, so people who have worked for 43 years can retire with a state pension before 64. Thomas Piketty argues that If you have 43 years of service, then you should be able to take your full pension, full stop. [1]

However this idea of replacing a retirement age by a years worked criteria emphasises a different potential unfairness problem, because state pensions are annuities that you receive for as long as you live. If everyone had the same life expectancy, then those who started work early and therefore retired early would receive a pension for longer than those who retired later. How much is this an issue? Just as when you start work varies by (or perhaps even defines) class, so life expectancy also varies by class.

It would be easy to argue that this potential unfairness, created by replacing a fixed retirement age by years of service criteria, doesn’t arise in practice because of an ‘unhappy coincidence’ that the life expectancy of those who start work earlier is shorter by the same number of years than those who work later. The evidence we have from France for those benefiting from ‘long careers’ and therefore early retirement in France is complex, but does not suggest such an unhappy coincidence exists. However, even if there was no difference in life expectancy between those who start work at 18 and those who start work at 21, say, that is not an argument for a common retirement age, because that is obviously unfair to those who start work at 18 and therefore contribute more to their pension with no additional benefit. [2]

If those who started work at 18 can retire on a full pension at 61 through the long career route, why does France have a retirement age at all and why is it being raised? The answer lies in the detail, and in particular the allowances for taking time off to look after children. In this respect the UK system, which gives credit for those receiving child benefit, is more generous than the system in France, although of course it is easier to be generous when the level of the state pension is so much lower. It might seem odd that these details have provoked so much anger, but as Piketty points out if they didn’t affect a lot of people by a considerable amount Macron wouldn’t be using so much political capital on insisting on raising the retirement age to 64.

The controversy in France over pensions has rather little to do with affordability, and instead is about lifetime choice and fairness across class. France was unusual compared to most countries because workers paid more to fund and enjoy a longer retirement, particularly for the working class who started work at 18 and particularly working class women. The danger in ending this is it will create one more weapon for the populist right.

[1] Why does France recognise the unfairness to those who start work early created by a fixed retirement age, while the UK does not? Indeed, why does raising the retirement age in the UK cause so little controversy compared to France. The obvious reason is class, and in particular the lack of political power in the UK for those who didn’t do a degree. Raising the retirement age from 62 to 64 in France primarily affects the working class, because those who did a degree and started work in their early twenties will need and often want to work beyond the age of 64 to get their full pension. It is the trade union movement in France that is leading the protests against raising the retirement age.

[2] One way of dealing with different life expectancies across occupations has been proposed by Ian Mulheirn. He suggests treating the pension as a lump sum that would have to be invested in an annuity, and the annuity provider would adjust for different group life expectancies. My own view is that a government run scheme would be preferable, because private annuities expose pension holders to interest rate risk.

No comments:

Post a Comment

Unfortunately because of spam with embedded links (which then flag up warnings about the whole site on some browsers), I have to personally moderate all comments. As a result, your comment may not appear for some time. In addition, I cannot publish comments with links to websites because it takes too much time to check whether these sites are legitimate.