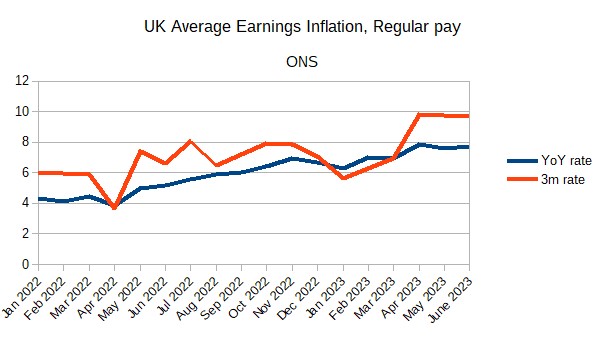

Two weeks ago I described how the UK’s inflation problem has now become about labour market strength and private sector wage inflation. Earnings data released last week has confirmed that view, in part because of the latest data but also because of revisions to the previous two months. Here is both year on year wage inflation, and the annualised three month rate.

Year on year wage inflation is at around 8%, and more recent increases have been above that. If that continues it is consistent with 6-7% inflation, which is well above the government’s target of 2%. So private sector wage inflation has to come down. Maybe wage inflation will follow price inflation down, or perhaps further efforts to reduce aggregate demand and therefore the demand for labour are needed. That question is not the subject of this post. Instead I discuss why some on the left find this diagnosis for our current (not past) inflation problem difficult.

A year or so ago, when inflation in the UK was primarily due to higher energy and then food prices, mainstream economists could legitimately be divided on what the policy response should be. On the one hand, decreasing aggregate demand in the UK was not going to have any effect on the drivers of inflation. On the other hand, it could be argued that policy should become restrictive to prevent higher inflation becoming embodied in expectations, because if that happened then inflation would remain too high after the energy and price shocks had gone away. To use some jargon, opinions will differ on what the policy response to supply shocks should be. Until the beginning of 2022 central banks went with the first argument, and did not raise interest rates. When nominal wage inflation started rising, and it became clear the labour market was tight, interest rates started to rise.

Now mainstream economists, at least in the UK, are on clearer ground. Excess demand in the labour market is pushing up wage inflation, and therefore aggregate demand needs to be reduced to bring private sector wage inflation down. There may also be excess demand in the goods market, pushing up profit margins, but the remedy would be the same. (Data on profits is less up to date than earnings, but as yet there is no clear evidence that the share of profits has risen in the UK.) Excess demand in either market needs to be eliminated, which requires policy to reduce aggregate demand, leading to fewer vacancies and almost certainly increased unemployment.

The understandable difficulty that many have with this diagnosis is that real wages have fallen substantially over the last two years, and nominal wage inflation is only just catching up with price inflation, so how can wages be the problem? I have addressed this many times, but let me try again in a slightly different way.

Inflation over the last two years has been about winners and losers. The winners have been energy and food producers, who have seen prices rise substantially without (in the case of energy at least) any increase in costs. To the extent that the government can (and is willing), profits from energy producers can be taxed and the proceeds returned to consumers through subsidies. But the reality is that much of these higher profits on energy and food production are received overseas, and there is nothing the UK government can do about them. As this is essentially a zero sum game, those who have benefited have to be matched by those who have lost. The only issue becomes how those losses are distributed between UK consumers, the profits of other UK firms, the government and its employees.

Workers in this situation could try and raise nominal wage inflation to moderate this loss in real wages, and that is one interpretation of what has been happening. Yet if those in the private sector are successful in this, who are the losers? They can only be firms, through lower profits. Why should firms reduce their profit margins when wages are rising across the board? In a weak goods market they might be prepared to do so, but there are no signs of that in the UK. So firms are likely to match higher wage inflation with higher price inflation. That is the major reason why the price of UK services has been increasing steadily over the last two years (now at 7.4%).

The key point is that UK real wages didn’t fall over the last two years because the profits of most UK firms rose. They fell because the profits of mainly overseas energy and food producers increased. Trying to shift this real wage cut onto the profits of other UK firms will not work, and instead just generates inflation. It is also why nominal wage inflation, not real wage inflation, is the crucial variable here. We could debate whether it would be a good idea to see real wages recover at the cost of falling profits, but it hasn’t happened so far and is unlikely to happen in the future unless excess demand is replaced by excess supply.

Those on the left who find it uncomfortable to hear that nominal wages are growing too rapidly need to remember that since at least WWII sustained real wage growth, or the absence of growth, in the UK has not come from lower profits, but instead comes mainly from productivity growth, with occasional contributions from commodity price movements and shifts in the exchange rate. The reason UK real wages have hardly increased over the last 15 odd years is because productivity growth has been very weak, energy and food prices have risen and sterling has seen two large depreciations. [1] The interests of workers are served by policies that help real wage growth, and not by seeing nominal wage growth well beyond what is consistent with low and stable inflation.

If high inflation is caused by excess demand then policy needs to decrease aggregate demand, which will reduce the demand for goods produced by most firms leading in turn to a reduced demand for labour. That almost certainly means unemployment rises. If you worry that the costs of additional unemployment is too high, then something like a Job Guarantee scheme makes a lot of sense, although the potential costs of such a scheme also need to be recognised. Such a scheme does not change the logic, however, that inflation that is caused by excess demand needs to be corrected by decreasing aggregate demand.

Is there an alternative to using weaker aggregate demand to bring down inflation? If wage inflation is too high, it is because firms are having to grant large nominal wage increases in order to get and keep workers. To avoid the symptom (high inflation) you need to remove its cause (a tight labour market), which means either increasing the supply of workers or reducing the demand for workers by firms. Because the former is not easy to do quickly (e.g. because of controls on immigration) then the latter requires a reduction in aggregate demand.

In the 60s and 70s, before oil price hikes made a bad situation worse, UK politicians and some economists were unwilling to see unemployment rise enough to stop inflation rising. Instead they tried to use price and wage controls to keep both inflation and unemployment low. This failed, and UK inflation rose from around 2% in the early 60s to 8% in the early 70s, before oil prices rose fourfold. The reason is obvious given the logic in the previous paragraph. If demand is sufficiently strong (and therefore unemployment sufficiently low) that firms want to grant nominal wages increases that are inconsistent with low inflation to attract more workers, then controls on prices and wages have to persist to stop inflation rising. But permanent aggregate controls stop productive firms attracting workers from unproductive firms, which damages long run real wage growth. Inevitably governments come under pressure to relax aggregate wage and price controls, and therefore all controls do is postpone the rise in inflation.

Judging by comments on past posts, the reaction of some on the left to all this is to deny the economics, by claiming for example that the Phillips curve doesn’t exist. This also happened a lot in the UK of the 60s and 70s. The Phillips curve may be hard to estimate (because of the importance of expectations), and may not be stable for long periods, but the core idea that unemployment and wage inflation are, other things being equal, likely to be inversely related at any point in time is sound, as has been shown time and time again since Phillip’s first regressions.

Evidence should always trump political preferences in economics. Occasionally I’m called a ‘left-leaning’ economist, but this is partly because on major issues since I started this blog economic evidence has pointed in a leftward direction e.g. austerity and Brexit were terrible ideas. Neither of those examples has anything to do with political values beyond the trivial [2]. Facts, at least since I have been writing this blog, tend to have a left wing bias.

Inevitably, things are very different for many outside economics (and a few academic economists as well). The discussions I find hardest following my posts are those with people whose politics do determine, intentionally or not, their economic views. Those exchanges are hard because however much economics I try and throw in, it’s never going to be decisive because it will not change their political views. In addition, if I’m arguing with them, their natural presumption may be that disagreement must arise because my politics is different from theirs, or worse still that the economic arguments I’m putting forward are made in bad faith because of hidden political motives.

To those who do this the best reply was given by Bertrand Russell in 1959:

“When you are studying any matter … ask yourself only what are the facts, and what is the truth that the facts bear out. Never let yourself be diverted either by what you wish to believe, or by what you think would have beneficent social effects if it were believed.”

[1] Brexit is responsible for one of those depreciations, and it has also lowered UK productivity growth.

[2[ By trivial, I mean that reducing most people’s real incomes by large amounts for no obvious gain is a bad idea.

No comments:

Post a Comment

Unfortunately because of spam with embedded links (which then flag up warnings about the whole site on some browsers), I have to personally moderate all comments. As a result, your comment may not appear for some time. In addition, I cannot publish comments with links to websites because it takes too much time to check whether these sites are legitimate.