“Former Tory cabinet minister David Davis said on Saturday that if the Conservatives were to become known as the party of high taxes, the damage to their economic reputation would be as deep and lasting as that inflicted on John Major’s government by the disaster of Black Wednesday in September 1992.” according to the Guardian. Is he right to be worried? As I pointed out after Sunak’s Spring Statement, for the average worker most of the fall in real wages after tax over the next two years is down to higher taxes. By next financial year compared to last year, the average pre-tax wage is expected to fall by 1%, but by 3% after tax as Sunak's tax rises take hold.

The reason is partly higher national insurance contributions, but also Sunak’s decision last Autumn to freeze income tax allowances over a number of years, which at a time of high inflation brings in a lot of money because it takes a lot of money off taxpayers. We can see the impact that both of these tax increases have on the government’s overall tax take by looking at the OBR’s series for national account taxes.

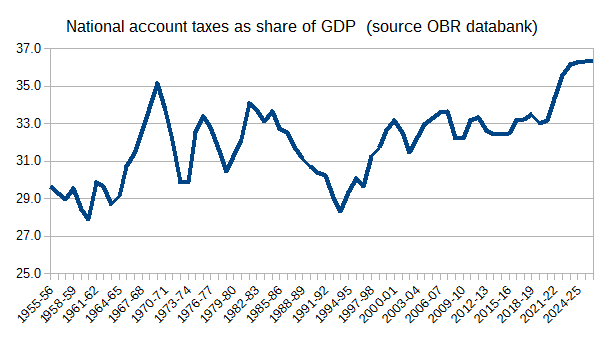

As many have pointed out, the share of total taxes in GDP is now expected to be higher than at any time since WWII.

It was partly Conservative MPs’ unhappiness with this prospect that led Sunak to focus on tax cutting in his Spring Statement rather than helping the poor cope with rising prices. Unfortunately, because of these numbers from the OBR, cutting taxes a bit after you had raised them a lot just six months earlier didn’t really cut it with public opinion. Partly as a result, Sunak is reported to be furious with the OBR, making the OBR yet another part of the UK’s pluralist democracy (after the courts and the civil service) that Tory ministers are furious with. (In Hungary, whose government is so admired by some on the right, the independent fiscal institution was the first to go.)

Sunak’s political failure of a few weeks ago will not stop him trying the same trick again, shortly before the next general election. He has already pledged to cut the basic rate of income tax by 1 percentage cent point, and if things go to plan he has scope to do more than that yet still claim debt as a share of GDP is falling. However, unless he is very lucky, the share of taxes in GDP will remain higher than it has ever been.

So how did Sunak find himself raising taxes as Chancellor for a political party that likes to see itself as the tax cutting party? As I have argued on a number of occasions, it is not because either the Chancellor or Prime Minister is more left wing than earlier Conservative holders of that office. Instead it is the result of two factors: health spending and austerity.

The reality that is outlined in all the OBR’s long term fiscal projections is that, as the UK population grows older and for other reasons, the share of spending in GDP on health and social care is bound to rise over time, just as it has since WWII (see the third chart here, for example). As health care is provided by the state in the UK, that means that taxes must rise (or borrowing must increase by more and more each year).

That is why there is an underlying upward trend in the share of taxes in national income, which is clear from the Chart above. The one sustained exception to this inevitability of higher taxes was over the Thatcher period, but that was both short-lived (reversed while the Conservatives were still in power) and the result of two one-off factors: North Sea Oil (see here) and privatisation. Of course good macroeconomics implies that neither should have been used to cut taxes, but that is another issue.

This upward trend in taxes would be even more evident if it wasn’t for two other things: falling defence spending after the end of the cold war (the ‘peace dividend’) and 2010 austerity. The former is over (and there is no obvious candidate to take its place), and the latter cannot be repeated because most areas of public spending have been cut back to levels that risk political costs for those in power. This includes the NHS, where waiting lists are now longer than at any other time.

On NHS spending the Chancellor in particular, and this government more generally, have made two big mistakes which will mean the extra spending they have provided for the NHS and social care will do little to improve health services. The first mistake was to declare the pandemic over before it was, which intensified the pressure of Covid on the NHS and is likely to mean waiting lists will continue to rise for some time. The second was not to treat any ‘catching up’ from operations delayed by the pandemic as a cost to be paid for by higher borrowing (like the furlough scheme) rather than by higher taxes. Sunak was too quick to try and demonstrate his deficit cutting prowess, rather than accepting that the pandemic would have fiscal costs even after it had actually ended.

Another potential mistake may be to allow higher inflation to raise taxes, but to leave short term nominal spending plans unchanged. The immediate difficulty this will cause is to squeeze even further (relative to the private sector) public sector pay. Public sector workers will of course try and avoid this squeeze, and it’s unclear whether any disruption that follows will be more politically costly to the government or opposition. The longer term difficulty is that this represents a further squeeze to real levels of public spending, which austerity had already cut to the bone.

As 2010-17 austerity has squeezed the public sector as far as politics will allow, and pressure from an ageing population means that public spending is bound to rise over time, that means that any Chancellor, of whatever colour, is likely to have to raise taxes as a share of GDP over their period of office, unless that period is very short. A Conservative Chancellor may raise taxes and public spending by less than a Labour Chancellor, but ‘raising taxes by less’ does not have the same electoral appeal as ‘tax cutting’ for Conservative MPs.

Is there any way out of this arithmetic for Conservative MPs? Ending the NHS, and replacing it by some kind of insurance scheme, is an alternative that has attracted some ministers in the past, but it faces a political obstacle that will be very hard to avoid. Beside the goodwill most voters have for the NHS, any insurance scheme will be particularly expensive for older voters, who of course tend to vote heavily Conservative.

Privatisation, which is ongoing, is not immediately costly in political terms (because it is hidden from most voters), but it is likely to make the NHS more rather than less expensive and therefore will increase the pressure to raise taxation. This is because the NHS, even though it is heavily under-resourced, is pretty efficient. Thus if it remains free at the point of use, provision in private hands will end up being more costly for the government to pay for, because private provision, even if it is equally efficient, needs to divert some profit to shareholders. So NHS privatisation, while it may be pursued for other reasons, does not get the Conservatives out of their need to raise taxes.

So Conservative MPs who think their party can once again become one that reduces the overall tax burden are living a fantasy. Of course the party and its Chancellor can, and will, raise taxes to cut them by less later and hope some people do not notice the trick being played. In addition the party and its Chancellor can, and will, raise some taxes so that others can be cut and hope some people do not notice the trick being played. But the wish to be a tax cutting party will mean that most public services including the NHS will, under a Conservative government, be permanently and chronically underfunded because the party, and its Chancellor, still has the dream of cutting taxes.

No comments:

Post a Comment

Unfortunately because of spam with embedded links (which then flag up warnings about the whole site on some browsers), I have to personally moderate all comments. As a result, your comment may not appear for some time. In addition, I cannot publish comments with links to websites because it takes too much time to check whether these sites are legitimate.