An interesting

disagreement

occurred this week between Martin Sandbu and the Economist, which

prompted a subsequent letter

from Philippe Legrain (see also Martin again here).

The key issue is whether the German current account surplus, which

has steadily risen from a small deficit in 2000 to a large surplus of

over 8% of GDP, is a problem or more particularly a drag on global

growth.

To assess whether

the surplus is a problem, it is helpful to discuss a key reason why

it arose. I have talked about this in detail many times before, and a

similar story has been told

by one of the five members of Germany’s Council of Economic

Experts, Peter Bofinger.

A short summary is that from the moment the

Eurozone was born Germany allowed wages to increase at a level that

was inconsistent with the EZ inflation target of ‘just below 2%’.

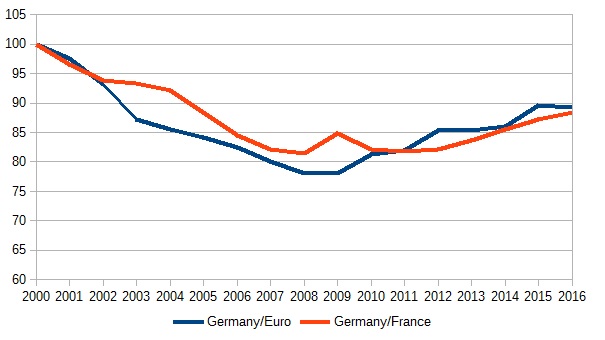

We can see this clearly in the following chart.

Relative unit labour

costs, source OECD Economic Outlook, 2000=100

The blue line shows

German unit labour costs relative to its competitors compared to the

same for the Euro area average. Obviously Germany is part of that

average, so this line reduces the extent of any competitiveness divergence between

Germany and other union partners. By keeping wage inflation low from

2000 to 2009, Germany steadily gained a competitive advantage over

other Eurozone countries.

At the time most

people focused on the excessive inflation in the periphery. But as

the red line shows, this was only half the story, because wage

inflation was too low in Germany compared to everyone else. This

growing competitive advantage was bound to lead to growing current

account surpluses.

However that in

itself is not enough to say there is a problem, for two related

reasons. First, perhaps Germany entered the Eurozone at an

uncompetitive exchange rate, so the chart above just shows a

correction to that. Second, perhaps Germany needs to be this

competitive because the private sector wants to save more than it

invests and therefore to buy foreign assets.

There are good

reasons, mainly to do with an ageing population, why the second point

might be true. (If it was also true in 2000, the first point could

also be true.) It makes sense on demographic grounds for Germany to

run a current account surplus. The key issue is how big a surplus.

Over 8% of GDP is huge, and I have always thought that it was much

too big to simply represent the underlying preferences of German

savers.

I’m glad to see

the IMF agrees. It suggests

that a current account surplus of between 2.5% to 5.5% represents a

medium term equilibrium. That would suggest that the competitiveness

correction that started in 2009 has still got some way to go. Why is

it taking so long? This confuses some into believing that the 8%

surplus must represent some kind of medium term equilibrium, because

surely disequilibrium caused by price and wage rigidities should have

unwound by now. The answer to that can also be found in an argument

that I and others put forward

a few years ago.

For this

competitiveness imbalance to unwind, we need either high wage growth

in Germany, low wage growth in the rest of the Eurozone, or both.

Given how low inflation is on average in the Eurozone, getting below

average wage inflation outside Germany is very difficult. The

reluctance of firms to impose wage cuts, or workers to accept them, is well known. As a result, the unwinding of competitiveness

imbalances in the Eurozone was always going to be slow if the

Eurozone was still recovering from its fiscal and monetary policy induced recession and therefore Eurozone average inflation was low. [1]

In that sense German

current account surpluses on their current scale are a symptom of two

underlying problems: a successful attempt by Germany to undercut

other Eurozone members before the GFC, and current low inflation in

the Eurozone. To the extent that Germany can make up for their past

mistakes by encouraging higher German wages (either directly, or

indirectly through an expansionary fiscal policy) they should. Not

only would that speed adjustment, but it would also discourage a

culture within Germany that says it is generally legitimate to

undercut other Eurozone members through low wage increases. [2]

From this

perspective, does that mean that the current excess surpluses in

Germany are a drag on global growth? Only in a very indirect way. If

higher German wages, or the means used to achieve them, boosted

demand and output in Germany then this would help global growth.

(Remember that ECB interest rates are stuck at their lower bound, so

there will be little monetary offset to any demand boost.) The

important point is that this demand boost is not so that Germany can

help out the world or other union members, but because Germany should

do what it can to correct a problem of its own making.

[1] Resistance to

nominal wage cuts becomes a much more powerful argument for a higher

inflation target in a monetary union where asymmetries mean

equilibrium exchange rates are likely to change over time.

[2] The rule in a

currency union is very simple. Once we have achieved a

competitiveness equilibrium, nominal wages should rise by 2% (the

inflation target) more than underlying national productivity. I

frequently get comments along the lines that setting wages lower than

this improves the competitiveness of the Eurozone as a whole. This is

incorrect, because if all union members moderate their wages in a

similar fashion EZ inflation would fall, prompting a monetary

stimulus to bring inflation back to 2% and wage inflation back to 2%

plus productivity growth.

If it wasn't for the Euro, this issue would have just sorted itself out automatically. Exchange rates would have shifted to increase German wages relative to those in the rest of the world.

ReplyDeleteRegarding the second footnote, aren't the comments you get incorrect also because the exchange rate of the Euro would adjust, thus negating any competitive advantage?

ReplyDeleteIf Germany hasn´t done much to help until now, it´s doubtful they will going forward.

ReplyDeletehttps://thefaintofheart.wordpress.com/2013/11/02/a-german-obsession-usually-proves-to-be-costly/

"Over 8% of GDP is huge, and I have always thought that it was much too big to simply represent the underlying preferences of German savers."

ReplyDelete25% of these 8% can simply be explained by energy prices: Around 2012, Germany paid almost 100 billion EUR for imported oil, NG and coal.

In contrast, the costs were only 30 billion in 2016, this means that more than 2% of GDP are saved by low price of oil and NG, nothing Germany can influence in the short term.

"a successful attempt by Germany to undercut other Eurozone members before the GFC"

Here a more nuanced argument would admit that most southern European countries felt entitled to wage increases way above productivity gains for many years after 2000, i.e. a lot of

the damage was inflicted by these countries themselve.

Without any doubt, the internal devaluation in Germany contributed, too. Now the interesting question (again)is, how do you handle different social cohesion in the Euro zone countries? Why do you not suggest internal devaluation in the southern European countries?

Ulenspiegel

Well, the high unemployment rate in the first half of the 2000s might have played a role too?

ReplyDeleteRemember the "sick man of Europe"?

10% unemployment (German definition of unemployment) might have depressed wage inflation a tad.

http://www.bpb.de/nachschlagen/zahlen-und-fakten/soziale-situation-in-deutschland/61718/arbeitslose-und-arbeitslosenquote

(in German)

That being said I do agree with you that the situation is now different. And the 8% surplus is clearly too high.

Detlef

As you know this huge surplus is not perceived in Germany as a problem but as a virtue.

ReplyDeleteAlso Mr Schäuble explained that since another crisis is coming, Germany has to get prepared: it should not just run a balance budget but decrease its debt. Now he will probably be gone in a few months but redent articles in the press mentioned possible successors who did not look less crazy but more.

By the way, I understand that the UK and US are enough to keep you busy but what do you think of the fabulous plans of the new French government? It seems like France is catching up with the fashion of 15 years ago (Blair, Schröder). Labour reforms will likely push wages down and the government's top priority is to reign in the deficit. Isn't it a recipe to kill growth just as it is returning?

I'm all for higher wages for German workers to solve the German trade surplus situation. But then, I worry that the argument might get flipped around to say that American workers need to take pay cuts to solve the US trade deficit situation. Is that reasonable?

ReplyDeleteSir,

ReplyDeleteIn what sector in particular must the wage in Germany increase? Do you mean in the sectors where German exports are disproportionately competitive? And how can the government achieve that - do they have direct power to do so in the private sector?

True, and said that six years ago:

ReplyDeletehttps://sites.google.com/site/savingtheeuro/

German supply chains increasingly are extending into Poland, Slovakia, Hungary and the Czech Republic, where wages are rising more rapidly than in Germany itself. Only Slovakia is within the Eurozone. Will this tend to ameliorate the situation relative to Southern Europe? What is the effect of the large capital investments by German companies in East-Central Europe? And why is capital flowing in that direction, rather than, say, Greece?

ReplyDelete